July 03, 2024

It’s quite common for your credit score to fluctuate, sometimes even every month. But what exactly goes into calculating your score?

Understanding how credit scoring models like FICO and Vantage Score operate can help you improve your score. This, in turn, can open the door to the best financial products in the market, such as premium credit cards and loans with lower interest rates.

With this in mind, let’s stake a closer look at how credit scores are calculated so you can take the steps you need to increase your score.

How Is Your Credit Score Calculated?

Credit scoring models such as FICO and VantageScore calculate your score using proprietary formulas to evaluate the data on your credit report. The exact scoring formula is kept secret; however, they do give an approximate idea of how they arrive at your score. For example, FICO considers the following factors:

- • Payment history (35%)

- • Amount owed (30%)

- • Length of credit history (15%)

- • New credit (10%)

- • Credit mix (10%)

Below we’ll take a closer look at what each factor entails.

Payment history

Your payment history is the most important credit scoring factor since, for lenders, it’s the main indicator of how well you manage debt.

Lenders prefer borrowers who consistently pay their bills on time, offering them favorables interest rates, higher credit limits and more. So, if you pay your credit cards and loans on time, you’ll most likely have a good credit score.

On the other hand, a single late payment can bring down your credit score by more than 50 points. Collections and foreclosures will lower your score even more, knocking off as much as 200 points.

Amount owed

Amount owed refers to how much debt you have. It includes:

- • Amount owed across all your accounts

- • Amount owed on specific types of accounts (credit cards and loans)

- • How many accounts have balances

However, the most significant factor when it comes to the amount owed is your credit utilization ratio, which is how much of your available credit you use each month. In simple terms, credit scoring models consider how much you’re spending on your credit cards compared to your cards’ credit limits.

Lenders consider it risky when borrowers have a high utilization ratio and most will prefer borrowers with a ratio of 30% or less.

To calculate your credit utilization ratio, divide your outstanding balance by your total credit limit. For example, if you have a credit card with a $3,000 balance and a $5,000 credit limit, you have a 60% ratio. In this case, lowering that percentage by paying down your credit card debt could potentially improve your score.

Length of credit history

The length of credit history, or credit age, indicates how long you’ve been using credit. To calculate it, scoring models take into account:

- • The age of your oldest credit account

- • The age of your newest credit account

- • The average age of all your credit accounts

Lenders prefer borrowers with long credit histories since it can provide a more comprehensive picture of how they handle credit accounts. For instance, a long history of on-time payments suggests you’re reliable when repaying debts.

On the other hand, a short credit history may not provide enough information for lenders to assess your risk as a borrower. This is why people with limited credit generally have lower credit scores compared to those with longer histories — assuming they have similar payment histories and credit utilization ratios.

New credit

New credit evaluates your recent credit activity, including recently opened credit accounts. It also takes into account hard inquiries lenders make when you apply for a credit card or loan.

Opening new credit accounts can positively impact your credit history if you pay them on time and keep a low utilization ratio. However, lenders may consider frequent credit applications within a short period of time as a sign of potential financial issues or taking on too much debt.

Additionally, too many new accounts can slightly lower your credit score by reducing the average length of your credit history.

Credit mix

Credit mix refers to the variety of credit accounts listed on your credit report.

There are two main types of credit accounts: revolving credit and installment credit. Revolving credit includes credit cards, which have a set credit limit you can borrow from and repay each month.

On the other hand, installment credit includes loans such as mortgages and auto loans. With these accounts, you borrow a fixed amount and repay in monthly payments over a set period of time.

Borrowers with a varied credit mix often have higher credit scores because it shows they can handle different types of debt. However, it’s best to avoid opening new accounts in an attempt to boost your credit score if it may result in unnecessary debt or financial strain.

VantageScore vs FICO Score

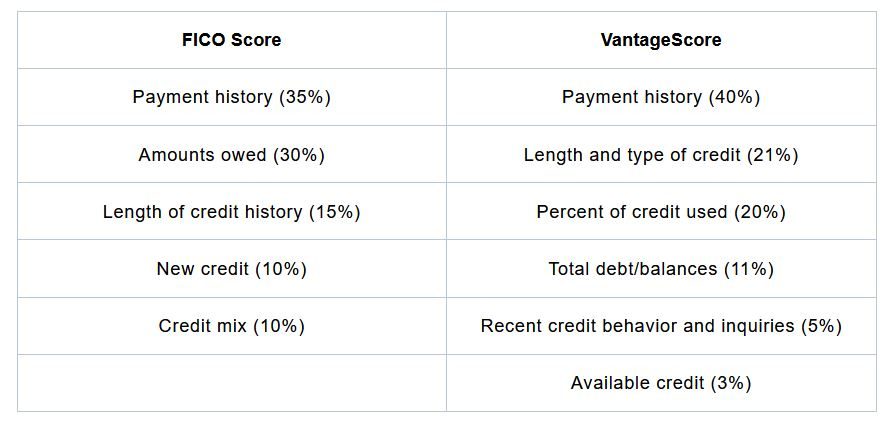

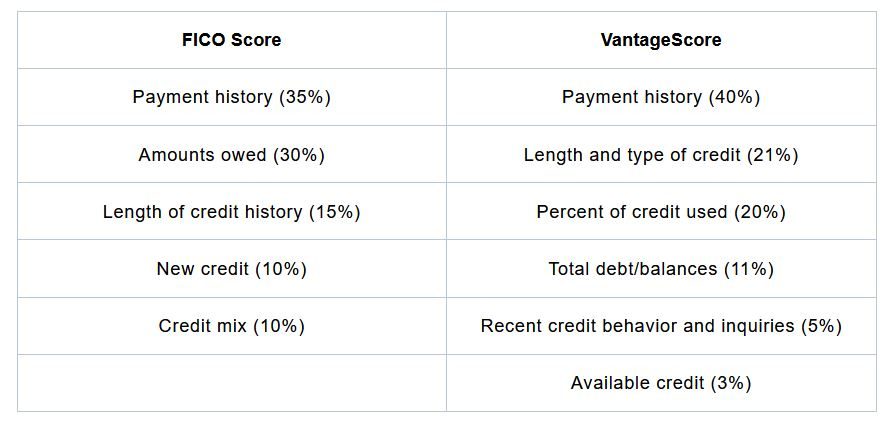

VantageScore and FICO Score use similar methods to calculate consumer credit scores. However, there’s a slight difference on how much weight they place on each factor:

While both credit scoring models use similar factors, it’s important to note that most lenders use the FICO scoring model.

Meanwhile, VantageScores are often used by websites that provide credit scores for free and by

credit monitoring services. This type of credit score is an excellent tool to track your credit standing and evaluate your overall financial health.

While both credit scoring models use similar factors, it’s important to note that most lenders use the FICO scoring model.

Meanwhile, VantageScores are often used by websites that provide credit scores for free and by credit monitoring services. This type of credit score is an excellent tool to track your credit standing and evaluate your overall financial health.

While both credit scoring models use similar factors, it’s important to note that most lenders use the FICO scoring model.

Meanwhile, VantageScores are often used by websites that provide credit scores for free and by credit monitoring services. This type of credit score is an excellent tool to track your credit standing and evaluate your overall financial health.